Currently, many investors and traders have invested in bitcoin as a safe haven asset and a long-term investment. But, as bitcoin evolves as a technology and a robust financial network, it will soon compete with reserve currencies, existing banking systems, and traditional assets such as gold.

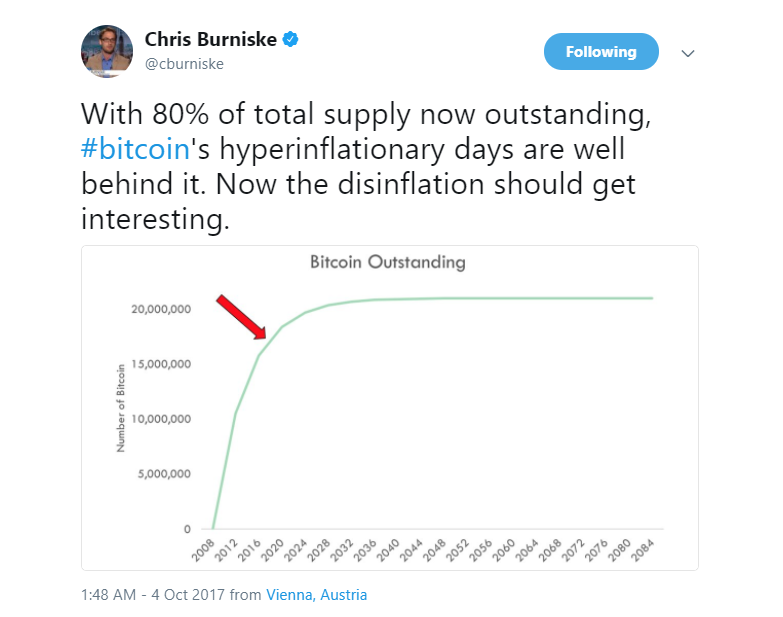

For the long-term growth of bitcoin’s market cap and price, its deflationary nature will be a vital factor to sustain bitcoin’s upward momentum and demand for bitcoin from the global market.

Because there will only be 21 million bitcoins and no additional bitcoin can be created after the supply achieves its cap, only a limited number of investors would be able to hold one full bitcoin.

But, bitcoin’s deflationary supply is not an issue for investors and merchants that adopt bitcoin as a digital currency because it is divisible. Currently, many bitcoin wallets and merchants use “satoshi” as a unit, with one satoshi representing 0.00000001 bitcoin.

******************************************************************

I have been using Bitclub Network to mine bitcoin for 2 years and have made a total of 16 Bitcoin with a Founder Position without Recruiting!

https://markethive.com/magistral/page/bitclubnetwork

Keine Kommentare:

Kommentar veröffentlichen